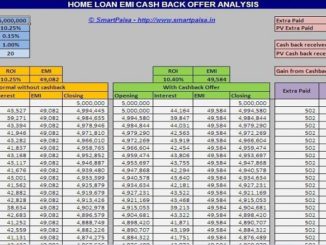

Home Loan EMI Cash Back Offer Analysis

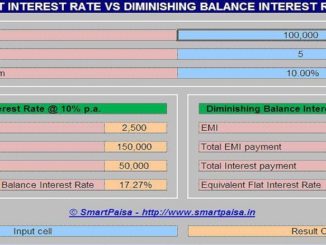

Pay just 0.15% extra and get 1% cash back. Wow – Great deal, No brainer! So you thought!! Many of us would have heard about cash back scheme on Home Loan Equated Monthly Instalments (EMI) Personal Finance guide to Mutual Funds, Stocks, Insurance, Investments, Loans, Tax Planning, Non-Resident Indians related issues